What is SurePay and How Does It Work?

In an era where digital transactions are the norm, ensuring payments reach the intended recipient is more critical than ever. SurePay is at the forefront of payment verification with its advanced Verification Of Payee (VOP) solution. Banks, businesses, and payment service providers across Europe rely on SurePay to reduce fraud, prevent misdirected payments, and enhance customer experience.

But how does SurePay work? What makes its algorithm exceptional? And why should banks integrate SurePay instead of developing their own solution? To understand why SurePay is the trusted solution for banks across Europe, let’s go back to where it all began.

The start of payment verification

In 2016, SurePay was founded as a startup within Rabobank, one of the largest banks in the Netherlands. The initial solution, then called the IBAN-Name Check, forms the foundation of today’s European Verification Of Payee (VOP) solutions, and was developed to combat payment fraud and misdirected payments, preventing financial losses and reducing administrative burdens for banks and businesses.

Within just a year, SurePay achieved a major milestone—connecting 99.5% of Dutch banks to their Verification Of Payee (VOP) API via a highly secure connection. This widespread adoption highlighted the urgent need for a VOP solution, and from there, SurePay expanded across Europe, helping banks, businesses, and consumers protect their transactions.

Today, the mission is clear: to protect banks and their customers against the growing threat of fraud, and to help banks be compliant with the Instant Payments Regulation.

How SurePay works

SurePay offers two main ways to perform these checks:

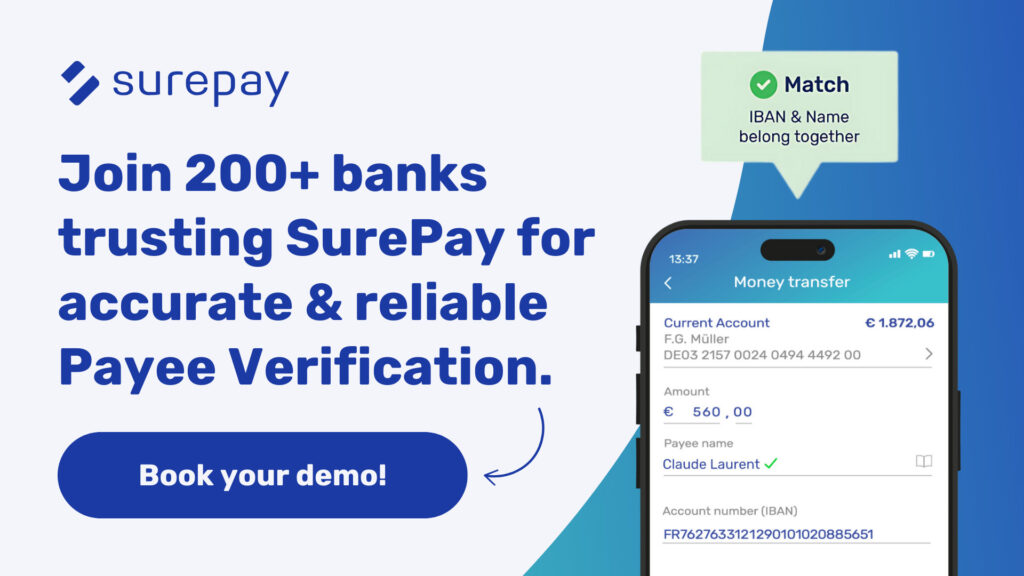

- Single checks – Used in online banking, mobile banking apps, or payment initiation screens, where a user enters an IBAN and a name, and SurePay instantly verifies if they match.

- Batch file checks (Bulk API)– Businesses can upload bulk payment files, and SurePay will verify multiple transactions at once.

Whether you do single or batch checks, SurePay will always flag potential mismatches before payments are processed.

Possible outcomes of a verification

- Match. The name provided by the payer fully matches the registered name associated with the IBAN. This confirms that the account details are correct, and the payer can proceed with confidence.

-

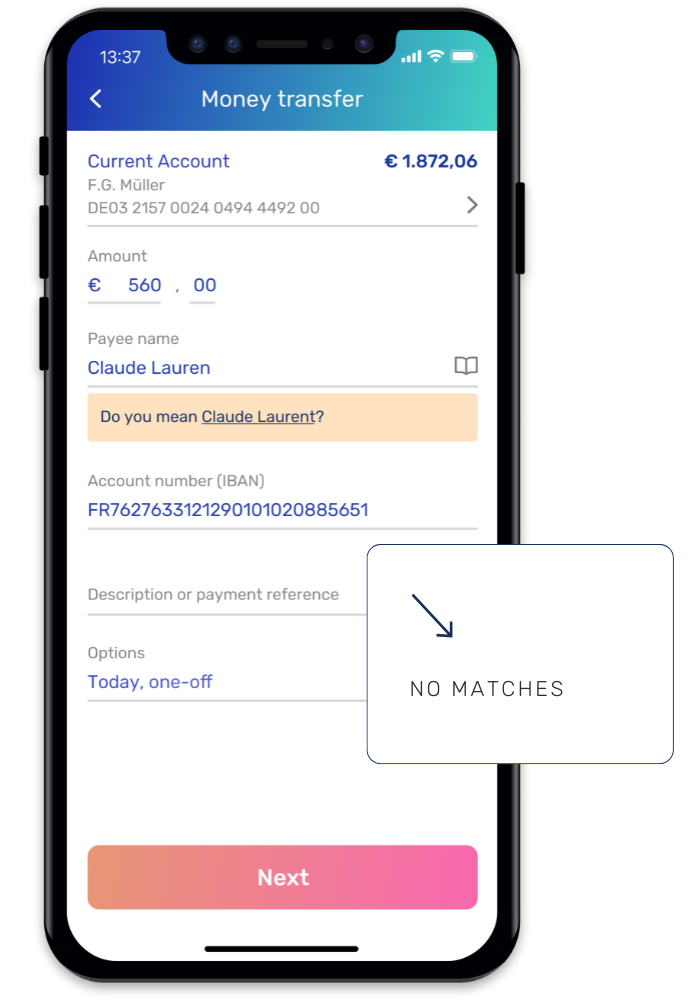

Close Match. The name provided is similar but not identical to the name linked to the IBAN. This can happen due to:

- Small typos (e.g., "Jonhson" instead of "Johnson")

- Common abbreviations or nicknames (e.g., "Liz" instead of "Elizabeth")

- Matching against a trading name (e.g., "SurePay Technologies B.V." vs. "SurePay B.V.")

- No Match. The provided name does not match the IBAN. This could indicate an incorrect entry, an outdated account name, or potential fraud. In this scenario, no name suggestion is provided for security reasons. It’s important to note that SurePay will never disclose more information than what the user originally provided.

- Not Applicable (NOAP). In some cases, a verification cannot be completed. This could be due to technical issues, timeouts, or the bank not being connected to the SurePay network. When a NOAP result occurs, the payer will be informed that verification is not possible at that moment, rather than receiving a misleading match or mismatch result.

-

Match

The IBAN and name match. Your records are in order. Download the pdf as burden of proof. -

Close match

If you make a typo in the name, we show the name known to the bank. You can copy the suggested name with just one click. -

No match

The IBAN and name do not match. Please contact the person you wanted to pay to and verify the payment information.

How SurePay determines the result

- Data collection: SurePay securely retrieves account information from banks and official sources (e.g., the Chamber of Commerce for business accounts).

- Name standardisation: The system accounts for different name formats, legal names vs. trade names, common abbreviations, and special characters.

- Advanced matching logic: The algorithm analyses how closely the entered name matches the official data, allowing for small variations while maintaining security.

- Fraud prevention rules: Certain mismatches—such as a high-value transaction with a "No Match" result—can indicate potential fraud, prompting additional security measures.

Why SurePay’s algorithm is the best

- Nicknames and abbreviations (e.g., Robert vs. Rob, Elizabeth vs. Betty)

- Trade names and legal business names (e.g., SurePay vs. SurePay Technologies)

- People who switch banks (ensuring continuity even after account migration)

- Minor typos (offering intelligent suggestions rather than outright rejection)

The power of Close Matches

Why banks should choose SurePay over building their own solution

1. One API – Simple integration, Europe-wide coverage

2. Unmatched accuracy and lower no-match rates

3. Fraud detection capabilities

The SurePay customer portal

For corporate clients, SurePay offers an intuitive customer portal, which mirrors the real-time VOP experience:

- Single payment verification: Users input an IBAN and a name to check if they match.

- Bulk verification: Clients upload payment files with multiple transactions for batch validation.

- Audit trail: A dashboard provides a full history of past checks, ensuring transparency and compliance.

This portal enables businesses to preemptively verify recipient details before processing payroll, supplier payments, or large financial transactions, reducing costly errors.

Conclusion

SurePay is the leading Verification of Payee solution in Europe, offering unmatched accuracy, fraud prevention, and seamless integration via a single API. Rather than developing their own complex and costly VOP system, banks can rely on SurePay’s proven technology to deliver better matches, fewer failed payments, and stronger fraud protection.

For banks, businesses, and payment service providers looking to enhance security and user experience, SurePay is the smart choice.

Would you like to see how SurePay works in action? Contact us today to schedule a demo!

- Reduced payment errors by 80%, minimising costly manual interventions

- Enhanced fraud prevention, blocking unauthorised payments before processing

- Improved customer experience, ensuring funds reached the correct recipients on time